Mandatum as an investment

Mandatum as an investment

An expert in money and life

Mandatum is one of Finland’s leading financial service providers. It combines expertise in money and life. The company’s expected growth is enabled by a strong market position, a renowned brand, highly competent personnel and successful investments. Mandatum is well-positioned to promote its potential future growth and value creation.

According to the view of Mandatum’s management, the company has major growth opportunities in capital-light pension, savings and risk insurance products that generate fee income, and in institutional wealth management and asset management operations. Mandatum’s new sales focus solely on unit-linked insurance, wealth management services and personal risk insurance. The company’s strategy focuses primarily on improving and cross-utilising its comprehensive product and service offering.

Mandatum offers its wealth management, corporate and private customers an extensive selection of complementary products and services. The company is able to serve a substantial share of Finland’s life insurance and investment market. It has some 20,000 Finnish corporate clients and approximately 330,000 private customers.

A key success factor for Mandatum is the precise targeting of a diverse service offering to suit the situations and needs of different customer segments. Using this approach, we will continue to produce added value for customers and the company’s own business alike. Mandatum’s key strength in product and service distribution is its competent sales and customer relations personnel.

Mandatum in figures

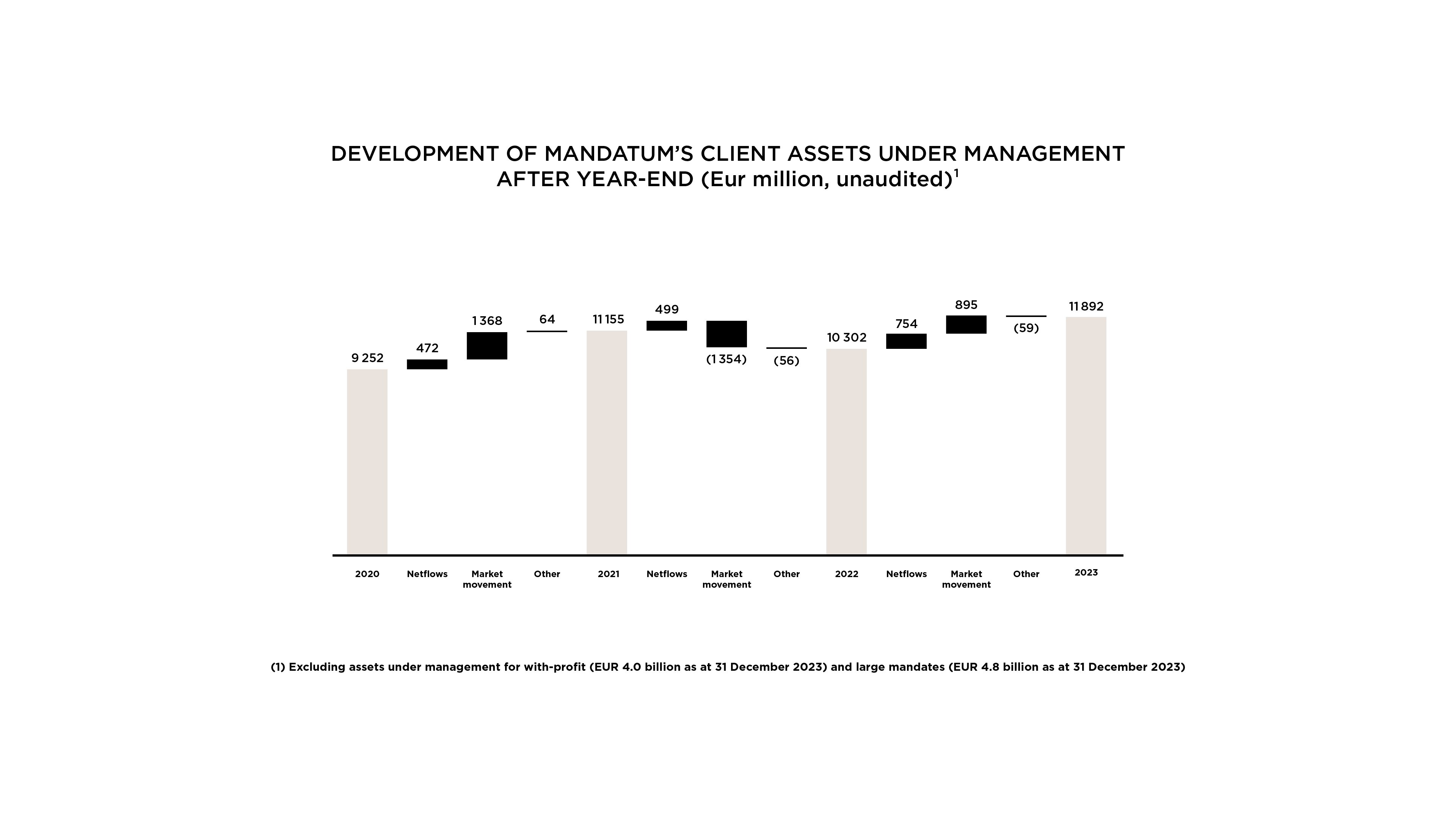

Customer assets under management EUR 11.9 billion*

(31 Dec 2023)

Net subscriptions EUR 543.9 million

(31 Dec 2022−30 Sep 2023)

Comprehensive income before taxes EUR 0.32 per share**

and equity EUR 3.19 per share**

(1 Jan−31 Dec 2023)

Total paid dividends approx. EUR 500 million

in 2021–2023

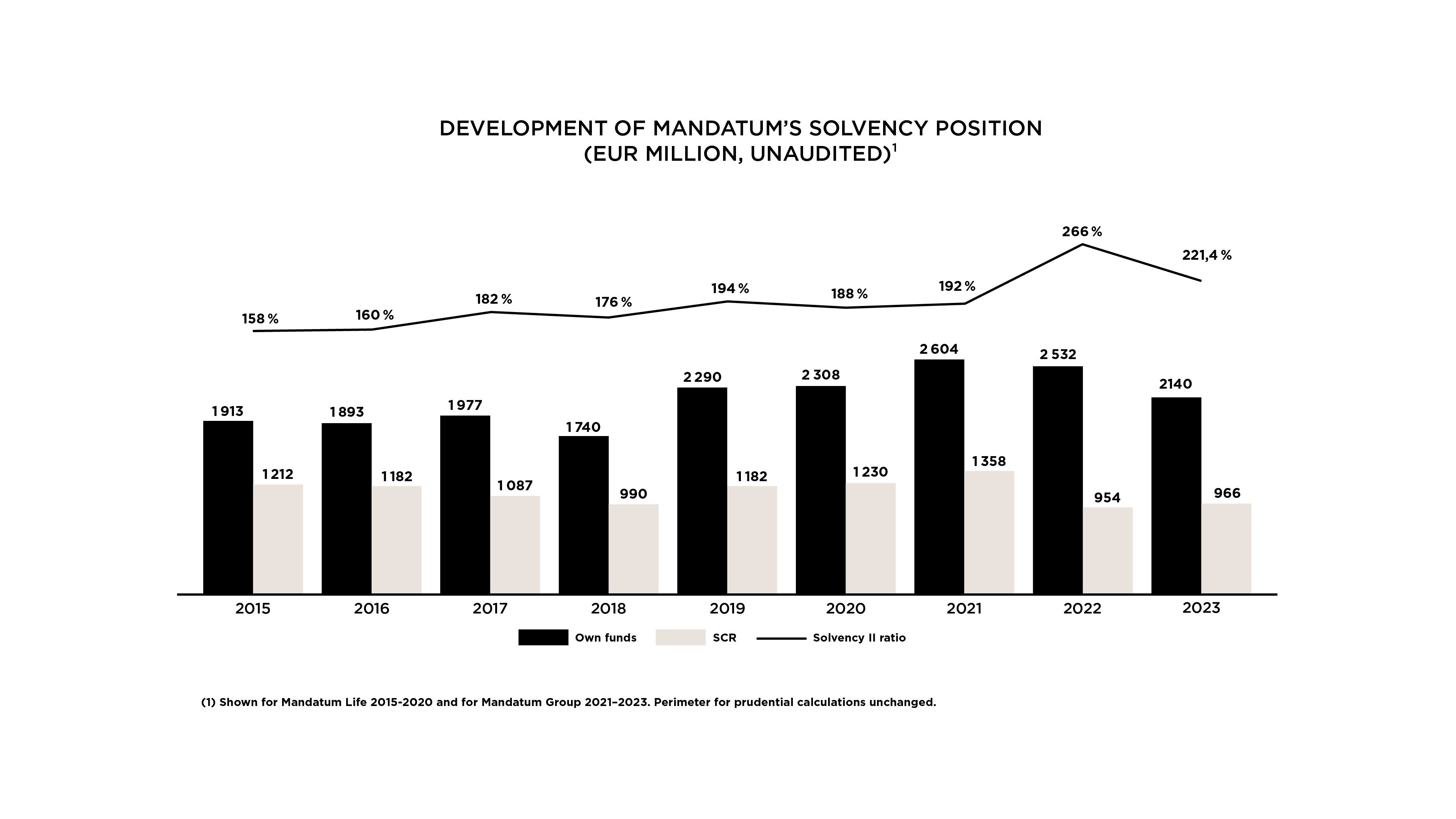

Solvency ratio 221,4 %

(31 Dec 2023)

*Annualized

**The number of shares used in the calculation corresponds to the number of shares after the partial demerger of Sampo Group on 2 October 2023: 501,796,752.

Mandatum’s business consists of four segments

Wealth management is a growth area

Mandatum focuses on growing its assets under management, primarily by expanding its wealth management segment. Wealth management customers include Finnish and Nordic institutional customers and ultra high net worth and high net worth individuals to whom the company offers services and products in different asset classes.

The targeted growth is made possible by ensuring the markets’ leading customer service experience as well as customer acquisition and service across segment boundaries. Of the total assets managed by Mandatum Group currently, more than 90% come from Finland, but the company has also succeeded in acquiring several significant institutional customers from Sweden and Denmark.

The expertise of Mandatum’s investment business is based on a long history of investments and a strong track record in investment returns*, especially in the fixed income and credit markets.

* Mandatum’s original with-profit portfolio and shareholder funds had a median 6.7 per cent return between 2013 and 2022.

Extensive investment expertise and experience

Market leader in the corporate segment*

Mandatum’s corporate clients include large cap, mid cap and small cap companies and entrepreneurs. The company offers these clients unit-linked group pension insurance, individual pension insurance, group risk insurance, individual risk insurance, and reward and compensation, personnel fund and pension fund services. Companies and corporate decision-makers with excess wealth are also potential wealth management customers.

A significant standing in the corporate segment* means having a broad point of contact with Finnish corporate decision-makers. This enables the cross-selling of products and services as part of managing and growing the overall client relationship. For example, currently, around 70 per cent of Mandatum’s wealth management customers have a business connection. According to the management’s assessment, the corporate segment enables Mandatum’s access to significant new and stable customer flows.

*Based on 2023 market shares in corporate insurance and pensions (Financial Supervisory Authority). Mandatum has an approximately 47 per cent market share in corporate clients’ unit-linked group pensions in the core markets. The share has been calculated bearing in mind the data on Mandatum’s own premiums written and the sector’s statistical premiums written.

Private customers are served directly and through partners

Private customers receive individual personal risk insurance covering death, unemployment and serious illness, and digital wealth management and investment solutions. Furthermore, Mandatum offers its private customers access to more than 70,000 investment instruments through Saxo Bank’s trading platforms. Insurance and investment solutions designed for private customers are mainly distributed through the partnership with Danske Bank and directly through Mandatum’s telesales and digital sales.

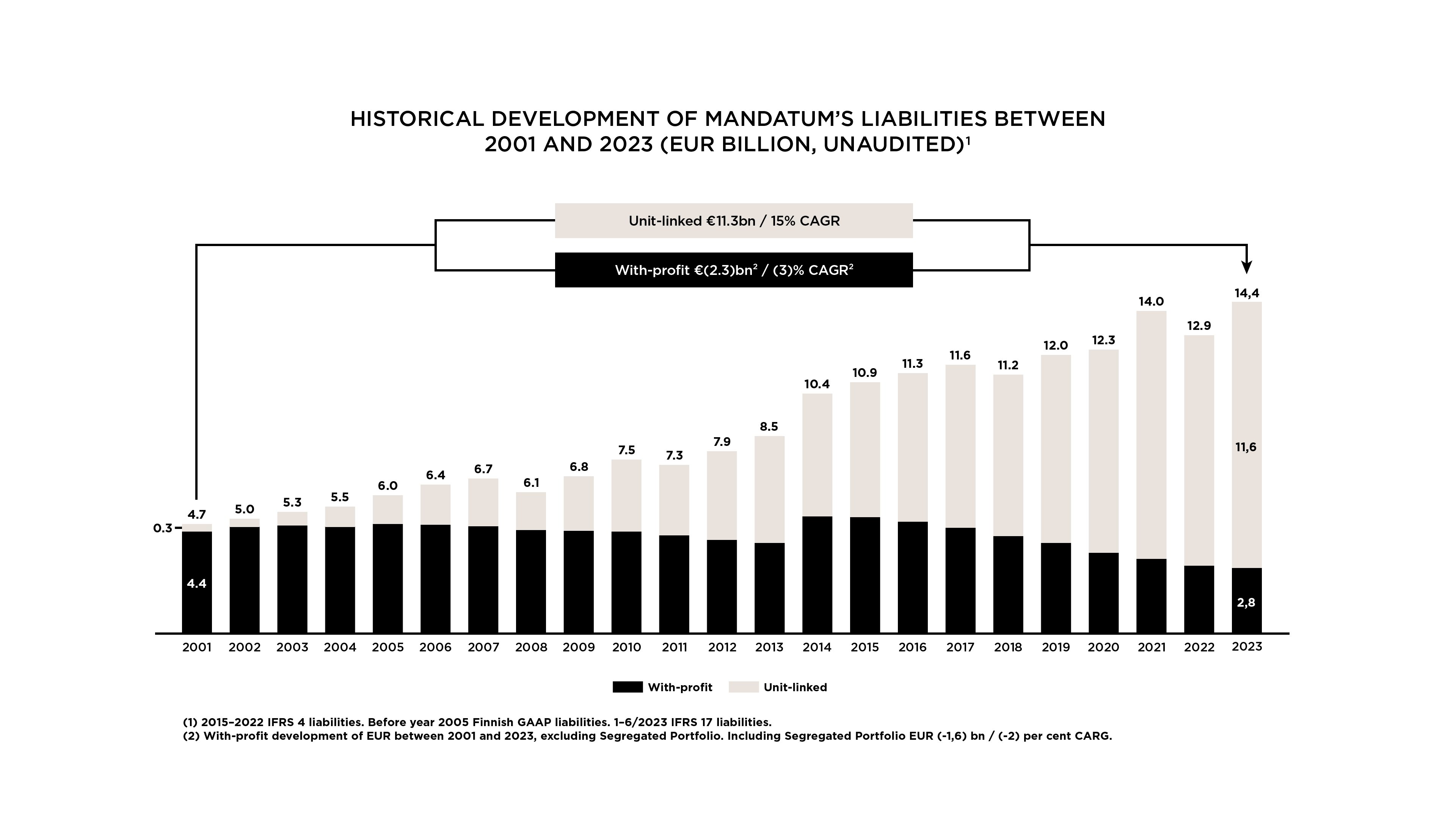

The effective management of the with-profit investment portfolio to generate capital and finance growth initiatives

In recent years, Mandatum has been able to create strong risk-adjusted investment returns* for the assets covering the with-profit insurance portfolio’s liabilities and shareholder assets. In addition, Mandatum’s strategy has been to accelerate the reduction of the with-profit portfolio. Together, these factors have enabled a strong cash flow and the financing of growth initiatives and maintained strong solvency.

The higher general interest rate level has made it possible for Mandatum to significantly reduce the risk profile of the investment assets covering the with-profit portfolio’s liabilities and shareholders’ assets by increasing the hedging ratio and allocation in fixed income investments.

* Mandatum’s original with-profit portfolio and shareholder funds had a median 6.7 per cent return between 2013 and 2022.

Development of Mandatum’s solvency position between 2015 and 2023 (EUR million, unaudited) 1

Historical development of Mandatum’s liabilities between 2001 and 2023 (EUR billion, unaudited) 1

Mandatum’s key strengths

1. One of the leading financial service providers with a strong brand and value creation model

2. Broad and complementary product offering and strong proprietary distribution capabilities

3. An attractive financial return and potential growth profile paired with a robust balance sheet and solvency position

4. Highly experienced management team supported by skilled employee base

5. Mandatum’s key value drivers

Value drivers

Mandatum’s key value drivers focus on:

- fee result

- net investment result

- result related to risk policies

- capital release

Fee result and result related to risk policies are the key value drivers for capital-light business while with-portfolio is especially driven by net investment result and capital release.

Financial targets

Mandatum’s financial targets are based on Mandatum’s proven experience and growth strategy, and they are built around capital distribution and the sustainability of the solvency position. This is supported by the targeted growth of the capital-light segment, together with the expected contraction of the with-profit portfolio.

Going forward, Mandatum’s goal is to maintain a resilient balance sheet and solvency position, and to support stable dividend payments and strategic growth initiatives with strong organic capital generation and management of the with-profit insurance portfolio.

Solvency ratio: Over the medium term, Mandatum’s target is a solvency ratio between 170 and 200 per cent.

Cumulative dividend 2024–2026: Between 2024 and 2026, Mandatum’s target is to distribute a total of EUR 500 million in cumulative dividends, with upside potential from excess capital distributions.

Segmental financial targets

Capital-light business

- Annual net subscriptions: Over the medium term, Mandatum’s target is annual net subscriptions amounting to 5 per cent of the customer assets under management *

- Fee margin: Mandatum’s target is the development of fee margins based on disciplined pricing

- Cost/income ratio: Mandatum’s goal is to improve the cost/income ratio **

With-profit business

- Development of technical provisions: Mandatum’s is targeting the with-profit technical run-off with active portfolio management actions.

* Based on the amount of customer assets under management at the start of the period.

** Based on investment and wealth management income and expenses.